It’s hard to maintain track of an exchange rate that fluctuates 24 hours a day.

It’s hard to maintain track of an exchange rate that fluctuates 24 hours a day.

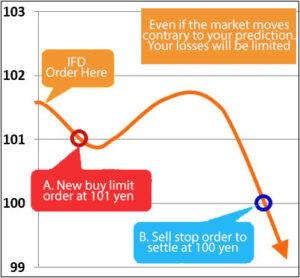

When you place an IFD order with a new order and a stop loss order for the settlement that limits the loss, even if the new order moves in the opposite direction without looking at the market price after the new order is filled, the stop loss order for the settlement is automatically triggered when the specified price is reached, allowing you to stop the loss from expanding further.

Because you never know when the market may move unexpectedly, it is essential to place a stop loss order when you initiate a trade. In general, it is preferable to utilize IFD orders in conjunction with Stop Loss orders to minimize losses rather than Take Profit Exit orders when dealing with them.