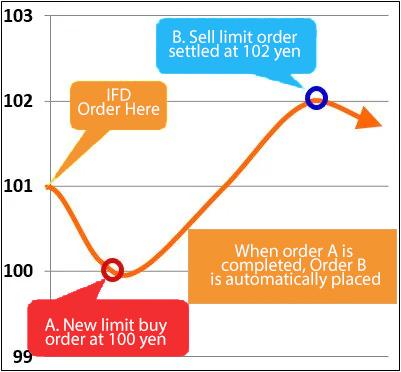

Assume the current currency rate is 101 yen, and you forecast that it would first decrease to 100 yen, then rise to around 102 yen. If the market moves as expected, the market will automatically perform from the new order to the settlement order if you make a new buy limit order at 100 yen in an IFD order and a sell limit order for the settlement that fixes the profit at 102 yen when the order is filled.

The sell limit order of 102 yen issued as a settlement order will not be executed initially if it climbs to 102 yen without falling to 100 yen.

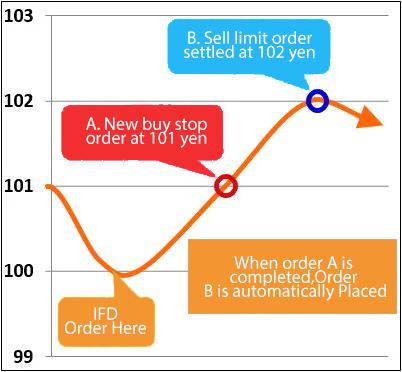

Furthermore, if the exchange rate reaches this level, there is a means of anticipating that the market’s flow would likely strengthen by putting a new buy stop order at that level and a profit-taking sell limit order at the next rate.