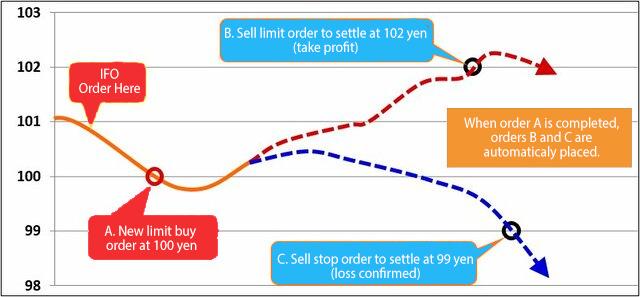

An IFO order is the result of combining IFD and OCO commands. “Ifdan OCO Order” is another name for it. It is an order mechanism that automatically issues a Take Profit limit order and a Stop Loss order for the position when a fresh order is placed.

For example, you could wish to begin a buy position when the exchange rate reaches 100 yen, and then settle for profit determination when it reaches 102 yen. I wish to settle the loss at 99 yen if it falls further once the fresh order is made at 100 yen… IFO orders are used in this situation.

Because the settlement half is an OCO order, if one is established, the other will be canceled immediately.

In this sense, it is a highly successful ordering technique if it can be employed after projecting the market’s future to some extent, because it executes automatically from entrance to profit taking or loss cut settlement.