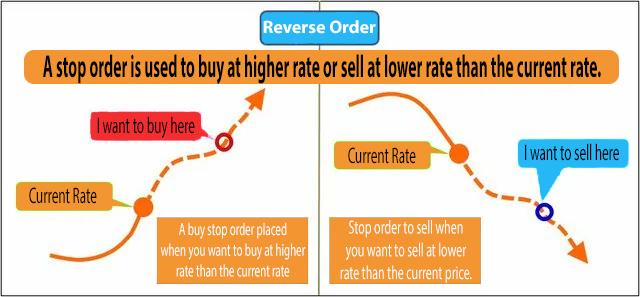

When you want to buy at or above this rate that is higher than the current rate, or when you want to sell at or below this rate that is lower than now, you place a stop loss order. Also referred to as a “stop order.”

A stop order is the opposite of a limit order, as the name suggests. In the case of Forex, a limit order is an order method for buying that specifies a lower rate or a higher rate than the current rate, whereas a stop order is an order method for buying that specifies a higher rate or a lower rate than the current rate.

Purchase at a greater price or sell at a cheaper price than it is presently. It may appear paradoxical at first appearance, but if used correctly, it may be incredibly successful.

In boxing, it is stated that “whoever controls the left wins the world,” but in Forex, it is believed that “whoever controls the stop order wins Forex,” thus it is an order strategy that you should never forget.