Stop orders provide the biggest advantage of limiting your losses.

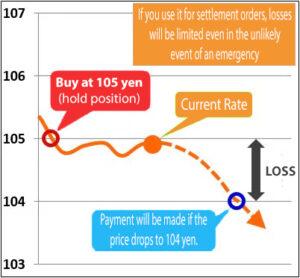

Assume you believe the exchange rate will climb and place a purchase order at 105 yen. If it increases as projected after that, it will be beneficial, but if it falls, unrealized loss (undetermined loss) will ensue.

I don’t want to have an y additional unrealized losses if it falls below 104 yen while I’m not watching at the market, therefore I’ll close the position and confirm the loss…. You will place a sell stop order of settlement at 104 yen in this situation. The position is automatically closed when it reaches 104 yen.

y additional unrealized losses if it falls below 104 yen while I’m not watching at the market, therefore I’ll close the position and confirm the loss…. You will place a sell stop order of settlement at 104 yen in this situation. The position is automatically closed when it reaches 104 yen.

If you place a stop order within the allowable loss range or loss amount, the trade will be closed when the indicated rate is reached, limiting further loss growth. Stop orders are sometimes known as “stop loss orders” since they are stop loss (stop) orders.

Because Forex is a leveraged market, risk management is critical. It is impossible to trade “100 victories in 100 bouts” no matter how skillful a trader is. Losses are obviously unpleasant, but if you maintain the loss within the acceptable range and execute a “courageous withdrawal,” you may recoup as much as you want with following trades.