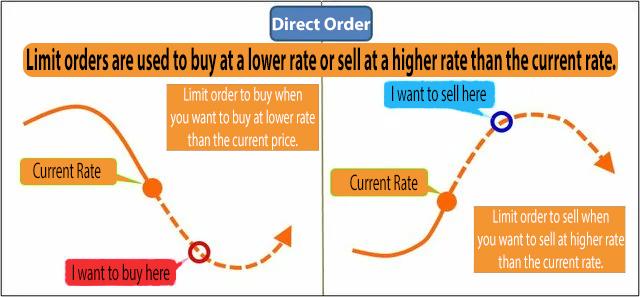

A limit order is an order that you make when you wish to purchase at a lower price than now or sell at a higher price than now. You indicate the price you want to be executed and put it. It’s also known as a “limit order” since it restricts the price at which it can be executed.

In the case of Forex, a buy limit order should be set at a lower rate than the current rate, and a sell limit order should be set at a higher rate than the current rate.

Rarely does the market continue to climb or fall on its own. Adjustments to the degree that the trend (market flow) does not collapse, referred to as reversals and rebounds, constitute rising and falling markets.

Assume the current exchange rate is 106 yen amid a rising market. If you believe it will not rise at the current rate, modify it once and then rise again, it will be more advantageous to be able to purchase at a slightly lower rate than to buy at the current rate of 106 yen. As a result, since it seems to adjust to around 105 yen, you may utilize it to place a fresh 105 yen buy limit order.

Furthermore, if the currency rate falls to about 105 yen during a falling market, it is likely to convert into an upward market from there, and it is also useful to place a fresh buy limit order at 105 yen.

A Buy Limit order will be completed in both situations if the exchange rate goes below 105 yen. Selling limit orders is the polar opposite of buying limit orders.

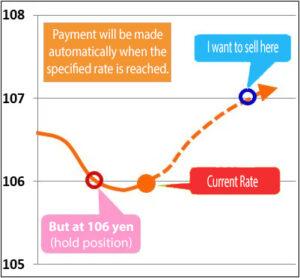

How to use it when making a payment Pending orders are also effective when closing a position. A sell limit order for settlement at 107 yen can be used to settle a position purchased at 106 yen at 107 yen and fix the profit. You can decide on a rule to lock in an unrealized profit (undetermined profit) and define the rate of the limit order depending on that rule when it occurs.

Pending orders are also effective when closing a position. A sell limit order for settlement at 107 yen can be used to settle a position purchased at 106 yen at 107 yen and fix the profit. You can decide on a rule to lock in an unrealized profit (undetermined profit) and define the rate of the limit order depending on that rule when it occurs.

In theory, pending orders are filled at a certain rate. It will not be filled at a less advantageous rate than the one indicated. If the current rate is more beneficial than the rate indicated in the limit order when you approach the stipulated rate, there are Forex providers that will allow you execute at the real rate.

When the chosen rate is achieved for limit orders, the Forex business immediately closes the deal, allowing you to trade at the desired rate even if you are not watching the market. However, it is possible that the rate may not reach the desired level, and the order will not be fulfilled.