If you want to make a trade like buying new at the lower end of the range and selling at the upper limit and closing at the upper limit, or selling new at the upper end of the range and buying and closing at the lower limit, you can use an OCO order to place a combination of new Buy Limit and new Sell Limit orders to respond to the entry regardless of which way the market moves.

If you want to make a trade like buying new at the lower end of the range and selling at the upper limit and closing at the upper limit, or selling new at the upper end of the range and buying and closing at the lower limit, you can use an OCO order to place a combination of new Buy Limit and new Sell Limit orders to respond to the entry regardless of which way the market moves.

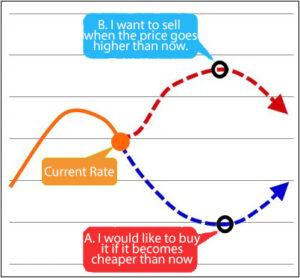

Furthermore, even though we do not know what will happen to the market in the future, if you place an OCO order like a figure when you want to enter a transaction with a new buy when it becomes cheaper than the current rate, or when you want to enter a trade with a new sell when it becomes higher than the current rate, you will be able to trade efficiently.

As a result, if you utilize an OCO order, you’ll be able to open a position at a better rate right now, regardless of how the market swings.