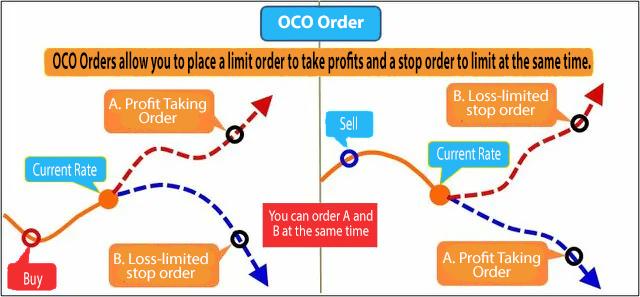

You can use a profit-taking sell limit order to execute when the price climbs to yen and a loss limit order to execute when the price falls to yen if you hold a buy position. It is a method such as setting a profit-taking buy limit order to execute when it falls to yen and a loss-limited purchase stop order to execute when it rises to yen when you hold a sell position.

You can respond no matter which direction the market swings since you can issue a series of profit taking and loss limiting orders (although this is not always the case). If either order is filled, the order that did not execute will be voided, allowing you to avoid blunders like forgetting to cancel the order.