In Forex, not only transactions that open a buy position when the exchange rate is expected to rise and fix the profit and loss by sell settlement, but also open a sell position first when the exchange rate is predicted to fall and make a profit and loss by buy settlement It is also possible to confirm .

Many people may feel uncomfortable with the transaction of selling even though they have not bought it. For example, selling US dollars / yen is synonymous with selling US dollars and buying yen (converting US dollars to yen). It seems that it is assumed that you have US dollars, and if you have a foreign currency deposit, you can only start trading in the direction of buying foreign currency, so I think it is reasonable to think so.

However, FX is a mechanism that targets only the movement of the exchange rate and exchanges the difference between the built rate and the settled rate as profit or loss, so if you think that the exchange rate will fall, sell it first and trade with buy settlement. It can be completed.

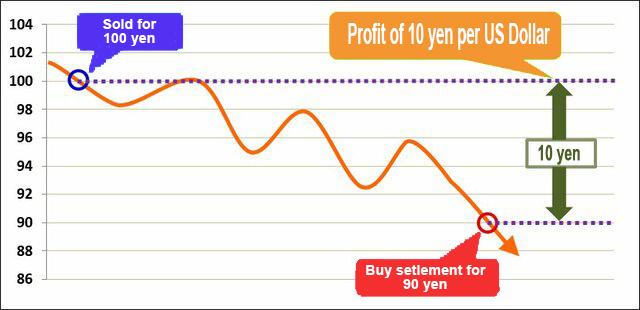

If you anticipate that the US dollar / yen will fall, open a sell position at 1 US dollar = 100 yen, and buy and settle when it drops to 90 yen as expected, you can get a profit of 10 yen per US dollar. I can do it. A profit of 10,000 yen for a 1000 currency transaction and 100,000 yen for a 10,000 currency transaction.

On the contrary, after selling US dollar / yen for 100 yen, the rate will rise to 110 yen, and if you buy and settle the position at that point, you will incur a loss of 10 yen per US dollar. It is a minus of 10,000 yen for 1000 currency transactions and 100,000 yen for 10,000 currency transactions.

If you think the exchange rate will rise, you will buy, and if you think it will fall, you will open a sell position and start trading. This is one of the major features of FX that is not found in individual stock trading or investment trusts.