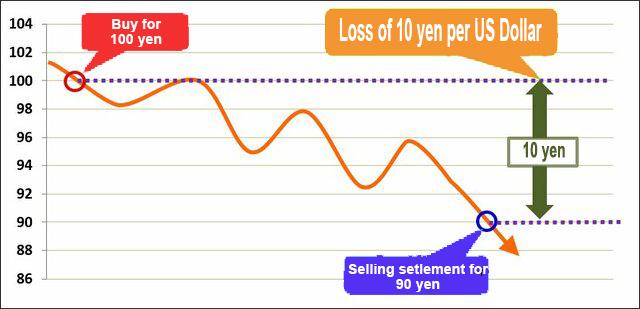

Hopefully the transaction goes well, but if the exchange rate moves in the opposite direction, you will lose money. What happens if you predict that the US dollar / yen will rise, open a buy position at 1 US dollar = 100 yen, then drop to 90 yen, and close the position at that point?

Since I bought it for 100 yen and sold it for 90 yen, I will lose 10 yen per US dollar. It is a minus of 10,000 yen for 1000 currency transactions and 100,000 yen for 10,000 currency transactions.

In other words, if you open a buy position with the expectation that the exchange rate will rise, you will make a profit if you can settle at a price higher than the price you built, and you will lose if you settle at a price lower than the price you built. This is the basis of Forex trading.