In forex trading, a rollover charge, also known as a swap or overnight interest rate, refers to the interest paid or earned for holding a currency position overnight. This charge is applied when a trader carries over their position from one trading day to the next. The rollover charge accounts for the interest rate differential between the two currencies in a currency pair.

Here's a breakdown of the concept with an example:

Suppose you are trading the EUR/USD currency pair, where the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. Let's say the European Central Bank (ECB) has an interest rate of 2%, and the U.S. Federal Reserve has an interest rate of 1%. The interest rate differential is 1%.

If you go long on EUR/USD, meaning you buy euros and sell dollars, you are essentially borrowing dollars to buy euros. Since the ECB has a higher interest rate, you would earn interest on the euros you bought, and you would have to pay interest on the borrowed dollars.

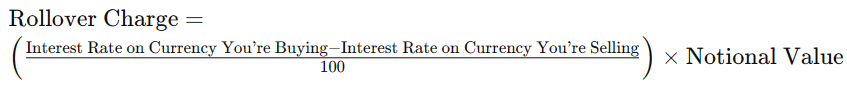

The rollover charge is calculated based on the interest rate differential and the notional value of the position. The formula for the rollover charge is:

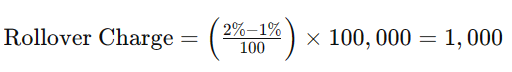

Using the example above, let's assume you are holding a position of 100,000 euros. The rollover charge would be:

In this case, you would earn a positive rollover charge of 1,000, indicating that you will receive interest for holding the position overnight.

Conversely, if you were to go short on EUR/USD (sell euros and buy dollars), you would be in a position to pay the rollover charge because you are borrowing euros with a lower interest rate and lending dollars with a higher interest rate.

It's important to note that rollover charges can vary among brokers, and some brokers may also adjust for weekends by applying a three-day rollover charge on Wednesdays to account for the period over the weekend. Traders should be aware of these charges and factor them into their overall trading strategy.