The level of currency rates indeed has a significant impact on swap points. The relationship between currency rates and swap points is closely tied to interest rate differentials, and it influences the overall cost or gain associated with holding a position overnight. Let's discuss this relationship with an example:

Consider a currency pair, such as EUR/USD, where the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. The interest rate set by the European Central Bank (ECB) for the euro is 2%, while the interest rate set by the U.S. Federal Reserve for the U.S. dollar is 1%. The interest rate differential is 1%.

Now, let's examine two scenarios based on different levels of currency rates:

- Scenario 1: Strengthening Euro

- If the euro strengthens against the U.S. dollar, let's say from 1 EUR/USD to 1.05 EUR/USD, it means it takes more dollars to buy one euro. In this scenario, the cost of borrowing in euros is lower, and the interest earned on holding euros is higher.

- The positive interest rate differential is magnified by the strengthening of the euro, leading to higher positive swap points for traders holding a long position in EUR/USD.

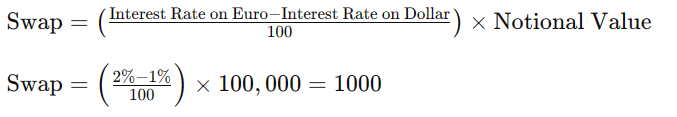

Example Calculation:

- In this case, the trader earns a positive swap of 5,000,000 for holding a long position in EUR/USD as a result of the strengthening euro.

- Scenario 2: Weakening Euro

- Conversely, if the euro weakens against the U.S. dollar, let's say from 1 EUR/USD to 0.95 EUR/USD, it means it takes fewer dollars to buy one euro. In this scenario, the cost of borrowing in euros is higher, and the interest earned on holding euros is lower.

- The negative interest rate differential is exacerbated by the weakening of the euro, leading to higher negative swap points for traders holding a long position in EUR/USD.

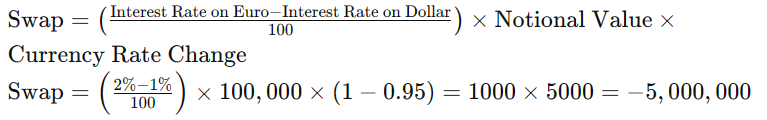

Example Calculation:

- In this case, the trader incurs a negative swap of 5,000,000 for holding a long position in EUR/USD due to the weakening euro.

In both scenarios, the level of currency rates plays a critical role in determining the impact on swap points, reflecting the interplay between interest rate differentials and currency price movements.