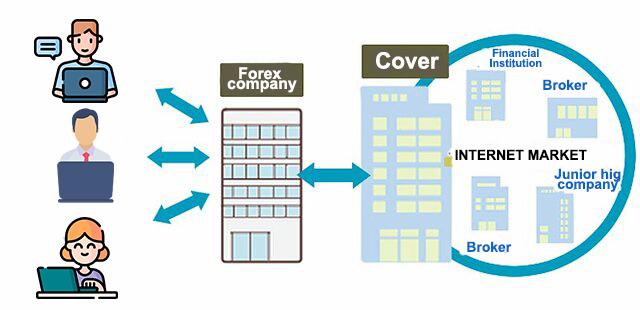

For Forex, transactions are bilateral. The trading partner of the investor (trader) is the FX company . If you place a US dollar / yen buy order to the Forex company and the order is completed, it means that the Forex company has sold the US dollar / yen.

In order to avoid the risk of exchange rate fluctuations as much as possible, Forex companies do not keep the positions (holdings) held in bilateral transactions with investors, but rather relative to financial institutions participating in the interbank market. Settle by transaction (the method depends on the Forex company).

Since FX is a contract for difference trading using margin, there is no concept that traders buy or sell currency directly. However, in reality, the Forex company acts as an intermediary between the trader and the interbank market, connecting the trader's buying and selling to the interbank market .

The financial institutions with which Forex companies are affiliated to conduct bilateral transactions are called "covered destinations". The covered financial institution makes a bilateral transaction with other participants in the interbank market and closes the position held in the transaction with the Forex company. This is a series of rough flow after an investor places an order with a Forex company and a transaction is completed.

The Forex company decides the rate to be offered to the investor by referring to the rate offered by the financial institution covered so as not to lose as much as possible in the bilateral transaction with the investor. Therefore, the rates that Forex companies offer to investors vary from Forex company to Forex company .

The more covers you have, the more options you have for Forex companies. It will be easier to close bilateral transactions with investors, and if you find a place that offers a favorable rate from multiple covers, the rate offered to investors may be advantageous accordingly.

It is not uncommon for Forex companies to have different rates, even when the forex market is calm and the exchange rates are volatile. It may be important to choose a Forex company that has many coverage and is likely to trade at the most favorable rate .