"Forex" is a transaction that takes advantage of the fluctuating exchange rate, and it is beneficial if you sell it for more than you paid for it (exchange rate) or buy it back for less than you paid for it.

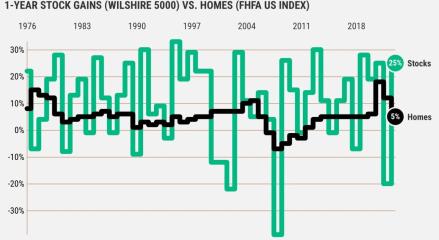

Of course, even if you aim to buy at a cheap price, the price may drop even further after you acquire it, or the price may rise even further after you sell it. Other financial products, such as stocks, work in the same way.

Furthermore, the difference between the price simply acquired and the price simply sold is traded as profit or loss in "Forex." You don't need to exchange currencies or make foreign currency deposits.

In this approach, a mechanism that trades only on the price movement of the target price is commonly referred to as a "CFD" in the financial market and a "difference settlement transaction" in Japanese. CFDs include stock price indexes, stock index futures, bonds, commodities (commodities), and other financial instruments, as well as "Forex."

Also, "margin" is used in Forex trading. A "margin" is a sum of money put in a Forex company's account as trading collateral. When you use "margin" in Forex, you're including a technique that allows you to trade with less money than the real trading scale, which is known as "leverage trading."