Avoiding or minimizing losses in trading is a critical goal for every trader. While it's impossible to completely eliminate losses, there are strategies and practices that traders use to reduce the likelihood of significant losses. Here are some tips to help minimize loss cuts in forex trading:

- Risk Management:

- Implement a sound risk management strategy. This includes determining the amount of capital you are willing to risk on each trade (risk per trade) and setting stop-loss orders to limit potential losses.

- Use Stop-Loss Orders:

- Always use stop-loss orders. Set stop-loss levels based on technical analysis, support and resistance, or other relevant market factors. This ensures that you have a predefined exit point if the market moves against your position.

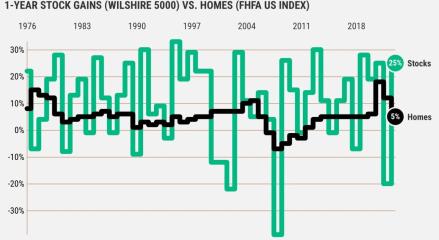

- Diversification:

- Diversify your trading portfolio. Avoid putting all your capital into a single trade or a few correlated trades. Diversification can help spread risk across different assets and reduce the impact of a single adverse market move.

- Stay Informed:

- Stay informed about market news and events. Sudden economic announcements or geopolitical events can significantly impact currency markets. Being aware of potential market-moving events can help you avoid unnecessary risks.

- Use Leverage Wisely:

- If you use leverage, do so cautiously. While leverage can amplify profits, it also magnifies losses. Consider using lower leverage to reduce the risk of significant drawdowns.

- Continuous Learning:

- Stay educated and continuously improve your trading skills. The more you understand the markets, technical analysis, and fundamental factors, the better equipped you'll be to make informed decisions and avoid unnecessary losses.

- Adapt to Market Conditions:

- Be adaptable to changing market conditions. Markets can be dynamic, and strategies that work in one type of market may not work in another. Adjust your trading approach based on the prevailing market conditions.

- Avoid Emotional Trading:

- Emotional decision-making can lead to impulsive actions and increased risk. Stick to your trading plan, and don't let fear or greed drive your decisions. Emotional discipline is a key component of successful trading.

- Backtesting and Analysis:

- Before implementing a trading strategy, backtest it on historical data to assess its performance. Regularly analyze your trading results and adjust your strategies based on your performance.

- Position Sizing:

- Determine the appropriate position size for each trade based on your risk tolerance and the distance to your stop-loss level. Avoid overleveraging, as it can increase the likelihood of significant losses.

Remember that losses are a natural part of trading, and no strategy can guarantee profits all the time. The goal is to manage and control risk effectively to protect your trading capital over the long term.